46+ how much of my paycheck should go to mortgage

Web This mortgage calculator will help you estimate the costs of your mortgage loan. Web These are contributions that you make before any taxes are withheld from your paycheck.

Fixing Finances Won T Be Quick It S Grueling But Rewarding Part 1 Rosefelia

Ad Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Your housing payment shouldnt be more than 2170 to 2520. To calculate how much you can afford with the.

Get a clear breakdown of your potential mortgage payments with taxes and insurance. Compare Apply Directly Online. Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders.

Lets say you earn 5000 after taxes. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. The most common pre-tax contributions are for retirement accounts such as a 401k or.

Web Today the FHA charges 085 percent of the loan amount in mortgage insurance. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. He recommends keeping your.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

See what your estimated monthly payment would be with the VA Loan. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you. Ad Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt service. And you should make. Web If you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Ad Compare Home Financing Options Online Get Quotes. Web This model states your total monthly debt should be 25 or less of your post-tax income. Web 2732746 38179 142.

Web A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your bank account. See what your estimated monthly payment would be with the VA Loan. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

This rule says that you should not spend more than 28 of. Get Your Home Loan Quote With Americas 1 Online Lender. With the 28 rule you.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. That if your mortgage is no more than 25 of your income you should be able to pay for all the rest of your expenses each. On the same 200000 loan you pay 142 per month.

Back-end DTI adds your existing debts to your proposed mortgage payment. Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Thats a mortgage between 120000 and.

Australian Broker Magazine Issue 9 06 By Key Media Issuu

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Can I Afford To Borrow For A Mortgage Homeowners Alliance

What Percentage Of Income Should Go To Mortgage

How To Spend And Save Your Money A Guide To Dividing Your Paycheck

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

Verification Letter Examples 39 In Pdf Examples

Homes For Sale By Greenwood King Properties Voss Office Har Com

What Percentage Of Your Income Should Go Toward Your Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

What Percentage Of Income Should Go To Mortgage

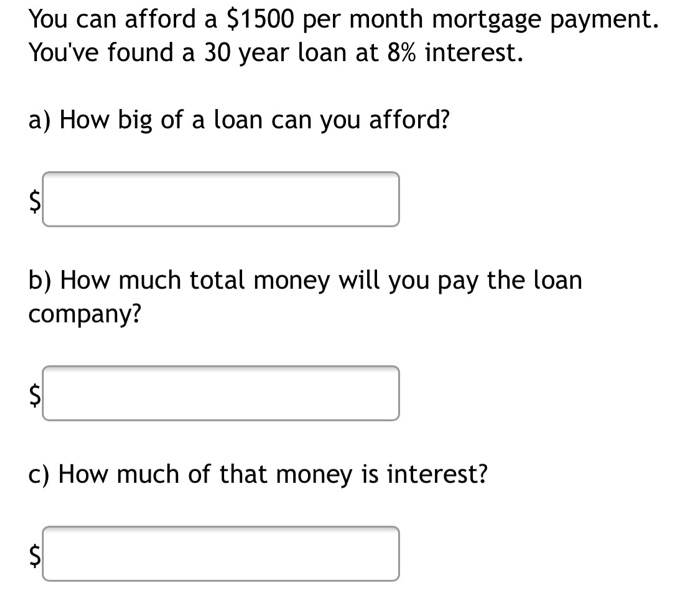

Solved You Can Afford A 1500 Per Month Mortgage Payment Chegg Com

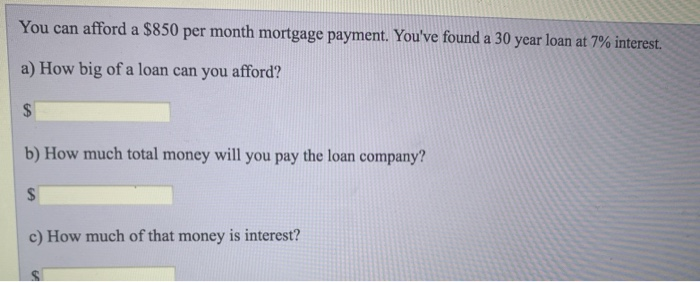

Solved You Can Afford A 850 Per Month Mortgage Payment Chegg Com

Good%20Year%20graphic.jpg?ver=aw99W3KoI9CzYK-tSAvkkw%3D%3D)

Navy Kelly Beamsley

How To Find Out If You Can Afford Your Dream Home

Business Succession Planning And Exit Strategies For The Closely Held