20+ Ltv ratio calculator

You can use a mortgage loan-to-value calculator to determine the cumulative LTV you are eligible for. It is likely but requires further analysis.

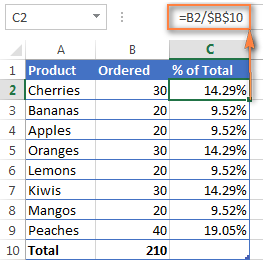

How To Calculate Percentage In Excel Percent Formula Examples

Choose the right currency if needed Input an estimate of your property value.

. Ad Calculate Your HELOC Amount Today. You need to divide 200000 by 250000 to find out what your LTV is. It is expressed as a percentage.

This is equal to 08 which is 80 when multiplied by 100. On a 500000 home only 15000 5000003 is required as a down payment. Now the loan-to-value ratio can be calculated for both properties by entering B2B3 into cell B4 and C2C3 into cell C4.

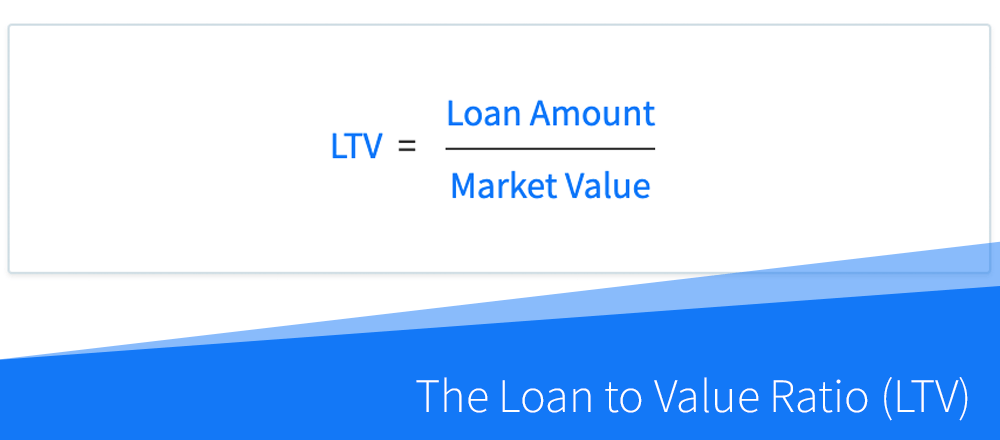

All you need to do is enter your deposit amount and the value of. Loan-to-value LTV is the ratio of. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value.

The LVR formula is calculated by dividing the loan by the propertys value. The loan to value ratio calculator exactly as you see it above is 100 free for you to use. After you have entered this information in the form you simply click the Calculate button for instant results.

Its also often referred to as being upside down or underwater on your loan. Click the Customize button above to learn more. However if the LTVCAC is greater than 1 it also does not automatically mean the company is creating value.

Besides using an LTV calculator you can also use the formula to calculate LTV. Mortgage insurance is optional but your mortgage lender may require you to obtain. In this case thats 480000600000 which makes the loan to value ratio 80.

If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. Find out your loan-to-value LTV ratio and check your eligibility for a new mortgage refinancing or a home equity line-of-credit HELOC.

Also known as conventional mortgages have a down payment greater than 20. Mortgage Loan 320000. LTV Ratio 80.

Jumbo mortgages require an LTV ratio of 80 or lower which is a down payment of at least 20. An additional loan of Rs20 Lakh increases the loan-to-value ratio to 625. The loan-to-value ratio is the amount of the mortgage compared with the value of the property.

That means your LTV is 80 percent and your deposit is 20 percent so you should look for an 80 percent LTV mortgage deal. A LTVCAC ratio of less than 10 indicates the company is losing value. An LTV over 100 means you owe more on the loan than your vehicle is worth.

A LTVCAC ratio of 3 or higher is usually considered value productive. Taking out a second mortgage on a property is more cumbersome than the first. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. The remaining 20 must be paid out of your pocket. If you get an 80000 mortgage to buy a 100000 home then the loan.

Loan to Value LTV Ratio 320000 400000. Key in the amount owed on your mortgage s. This online calculator is ideal for use with both home mortgage purchase and home mortgage refinance plans.

The good rule of thumb is that the bigger your. Loan to Value LTV Calculator. Conventional mortgages can allow for an LTV ratio of up to 97 or a downpayment as low as 3.

The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility. Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. Of course to make it easier you can just use our loan to value mortgage calculator above.

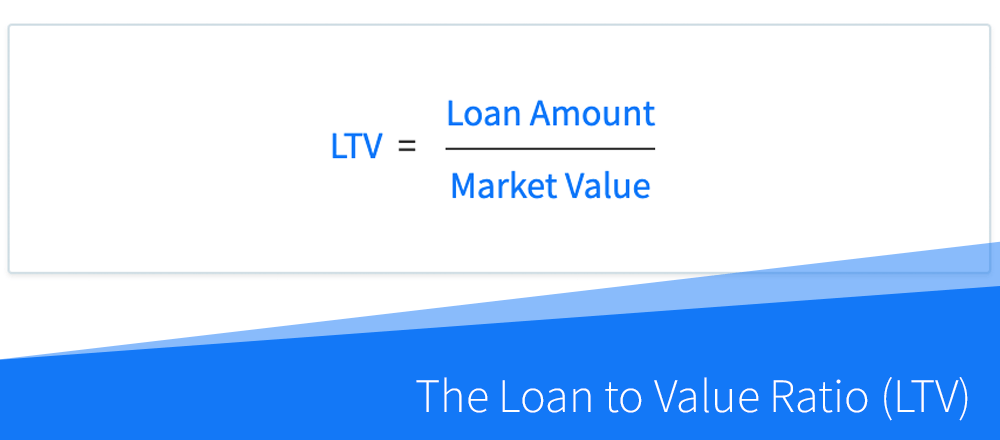

Loan-To-Value Ratio - LTV Ratio. To find out your LTV simply divide 200000 by 250000 and then multiply by 100. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80. This gives you an LTV of 80 so you should look for mortgage deals that are available up to 80 LTV.

The formula for LTV is. So using a loan value calculator is still a better option as it provides 100. Current combined loan balance Current appraised value CLTV.

For example if youre buying an apartment costing 600000 and you have a deposit of 120000 you will need a loan for 480000. Down Payment 80000. Although this formula for calculating LTV isnt hard to understand but sometimes leads to an inaccurate result.

You only have to enter two components to learn your loan to value. How to calculate Loan-to-Value LTV. The other method to know loan to value is LTV calculator that can help you in calculating LTV.

To calculate your LTV rate simply. Your home currently appraises for 200000. This is considered negative equity.

You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or online account and you want to take out a 25000 home equity line of credit. Our Loan to Value LTV Calculator is easy to use. Next enter 500000 into cell B3 and 2000000 into cell C3.

The loan-to-value ratio commonly referred to as LTV is a comparison of your cars value to how much you owe on the loan. Enter your estimated home value and your mortgage balance to calculate your loan-to-value information. The resulting loan-to-value ratio for the first property is 70 and the loan-to-value ratio for the second property is 9250.

LTV Mortgage Amount Appraised property value.

Customer Lifetime Value An Ultimate Guide

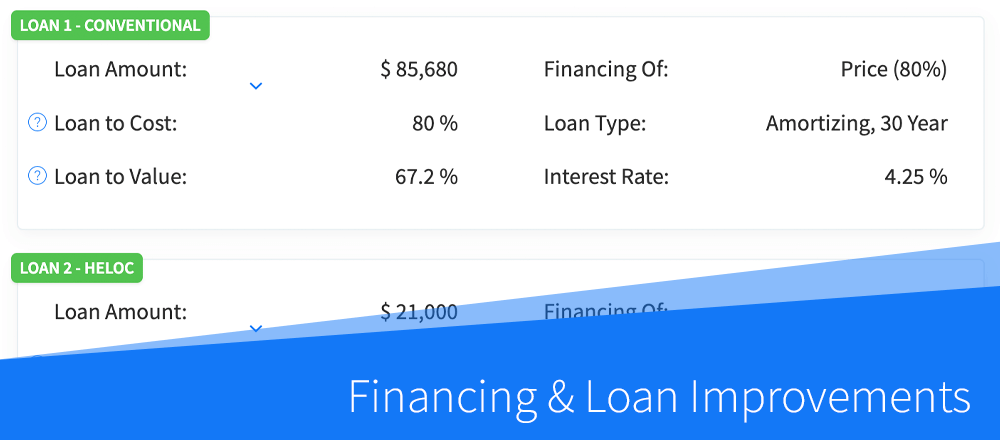

Dealcheck Blog Dealcheck

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Kw5vcwxmxccu6m

Dealcheck Blog Dealcheck

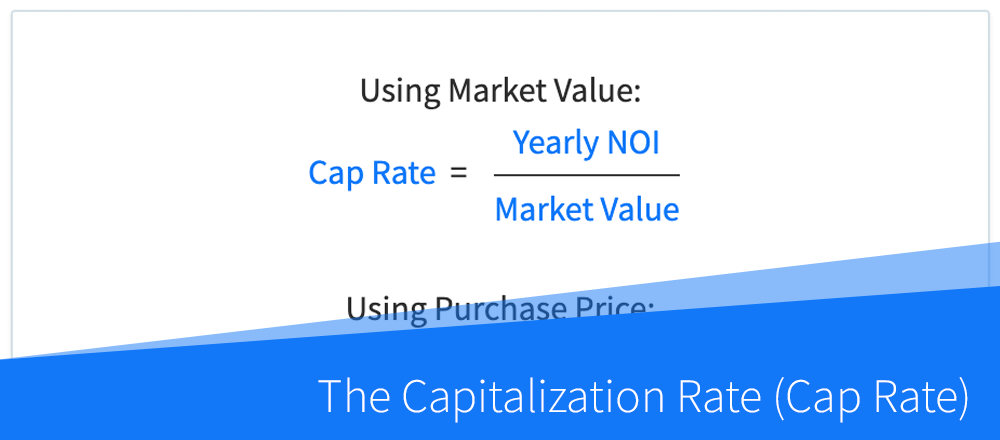

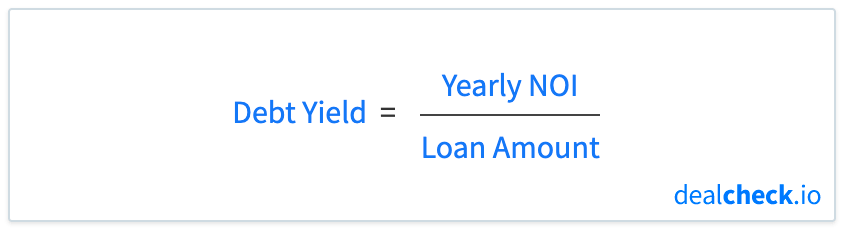

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Loan To Value Ratio Ltv Formula And Example Calculation

Everything About Debt To Income Ratio And How To Calculate It

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Predictive Ltv

Calculate The Loan To Value Ltv Ratio Using Excel

Loan To Value Ratio Ltv Formula And Example Calculation

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity