How much mortgage could i qualify for

Input your numbers to estimate what you can expect your mortgage payments might be. 37500 per year.

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

Mortgage insurers are very conservative when assessing a 95 home loan or 90 home loan so it is unlikely that you can get approval for such loans from every lender.

. Skip to main content. When is the first mortgage payment due. Borrowers who may qualify for mortgage deals but with high rates.

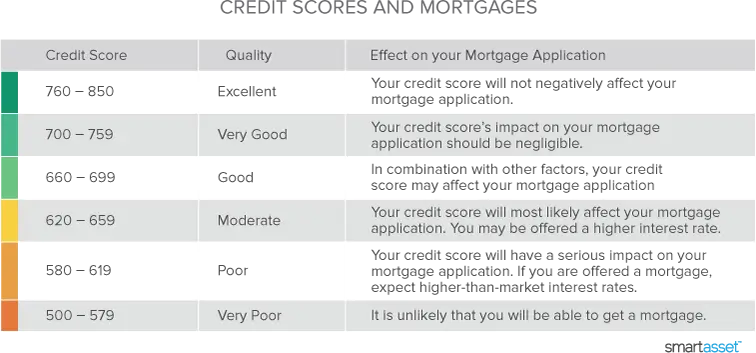

What credit score do I need to get approved. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. What is a mortgage refinance.

Fannie Mae HomePath. In order to qualify for a mortgage you have to show the lender how your credit score stands. Unlike most mortgage brokers we work out which lenders may approve your loan before providing you with a quote.

Your credit score is based on how well you handle managing debt and how much of it you have outstanding at any given time. This could create a significant problem for borrowers working their way towards PSLF because not all repayment plans qualify for PSLF. Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home.

In many cases a co-signer is used to help a borrower obtain better mortgage terms than they could have without one. Some lenders charge a small fee when you submit your application. This looks at how much you make in proportion to how much the mortgage will cost you each month including extras like private mortgage insurance homeowners insurance and property taxes.

Calculation results does not indicate whether you qualify or assumes you could qualify for the loan product or service. Here are the lowest and highest annual incomes that qualify for a 200K loan using mainstream criteria for a 30-year fixed-rate mortgage. We have approximately 1000000 in equity as follows.

Fortunately Congress contemplated this exact issue when it created the PSLF program. A reverse mortgage is a loan taken out against the value of your home. Use Our Mortgage Qualification Calculator.

Getting a mortgage can involve a lot of steps and you wouldnt want to get too far into the process before realizing you wont qualify after all. Your Guide To 2015 US. How much will my housing payment really be.

Even if you are a renter or dont have plans to buy right now its a good idea to get smart about credit and know ways you can build and maintain strong credit. This is also sometimes bundled with the origination costs. In addition your credit score could dictate the interest rate that you get and how much of a down payment will be required.

Borrowers who could secure good mortgage deals with reasonable rates. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. Do I even qualify for a mortgage.

How large of a mortgage can I afford. You can and should calculate your mortgage payment for. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

Review Your Credit Report. Very Poor 0 560. The front-end ratio is also called the housing-expense ratio.

How long will I live in this home. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Do I need to get pre-qualified for a mortgage.

Typically lenders cap the mortgage at 28 percent of your monthly income. If you are 62 years old or older and have considerable home equity you can borrow against the value of your home and receive. In the US the Federal government created several programs or government sponsored.

In some states. What is an FHA mortgage. Application fee 100.

Homeowner Tax Deductions. Why might I be. That is the primary borrower may have been able to get some type of mortgage on their own but having a co-signer enables them to get a loan with a lower interest rate a smaller down payment or a higher loan amount than they.

Talk to your lender if you have one in mind about any additional details and requirements for what they can offer you. Find out how much you could borrow with a home equity line of credit based on your homes value and your mortgage balance using NerdWallets HELOC calculator. Borrowers likely declined by lenders usually gets mortgages with high rates.

We could sell our home although we really want to live in it. As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate. Mortgage insurance protects your lender and the mortgage investor if you dont make payments and default on your loan.

The longer term will provide a more affordable monthly. How much house can I afford. Before the subprime mortgage crisis of 2008-2009 just about anyone could get a mortgage or two or three.

Attorney fee 150 to 500. No mortgage insurance. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

For example someone could theoretically make 100 of the necessary 120 payments and then lose IBR or PAYE eligibility. If you put down less than 20 youll likely have to pay for mortgage insurance which can involve a monthly fee as well as an upfront fee depending on the loan option you qualify for. Poor 561 720.

We are not able to pay off the current mortgage. Please let me know if your reverse mortgage is an option. We are wondering if a proprietary reverse mortgage could work for us.

Many mortgages also have minimum credit score requirements.

What You Need To Know About The Mortgage Process Infographic Mortgage Process Mortgage Infographic Real Estate Infographic

Money Under 30 Simple Honest Financial Advice Mortgage Mortgage Payment Shop House Plans

As A Real Estate Agent I Get Questions From My Clients All The Time About What They Should Ask Th Real Estate Infographic Mortgage Lenders Better Money Habits

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

Pin On Mortgage Oayment Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Personal Budget Mortgage Canning

How Much House Can I Afford Insider Tips And Home Affordability Calculator Personal Budget Mortgage Canning

How Much Mortgage Can I Afford Smartasset Com

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

How Much House Can You Afford Home Loans Loan Company Mortgage Companies

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

How Much Home Can I Afford Mortgage Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Mortgage Mortgage Payment